Comparing Yield to Maturity vs. Coupon Rate: Key Differences

Jan 25, 2024 By Triston Martin

Bonds are a kind of fixed-income security in which the investor receives a regular and predictable return on their money. Since they have a reduced chance of default and give a better return than conventional choices like bank FDs, they're one of the finest investments for risk-averse investors. However, when considering a bond investment, most people seem to conflate two different metrics: the coupon rate and the yield to maturity. Both of these measures don't really mean the same thing, despite common belief to the contrary. Read on to learn the difference between bond coupon rate and yield to maturity.

What Is the Coupon Rate?

The coupon rate of a bond is the annual percentage rate at which interest payments are made to the bondholder. It is the percentage rate expressed annually that indicates the amount of interest the bond pays out as a proportion of its face value. To further grasp the idea of coupon rates, let's look at an example. Let's pretend a corporation has issued a bond for Rs. 10,000. The annual interest rate for this bond is 10%. The annual coupon rate, in this case, is 10%. If you put Rs. 10,000 in the bond, you will earn Rs.1,000 in interest payments annually.

What Is Yield to Maturity?

Whenever we go into the concept of yield to maturity, we should realize that bonds, once originally subscribed by investors, may be sold freely on the market, just like stock shares. An investor's return on a bond from the day it is purchased to its maturity is known as yield to maturity (YTM). To investors, the YTM is only significant when they are purchasing bonds on the secondary market.

Key Differences Between Yield and Coupons

The Coupon vs. Yield debate is a hot one in the financial world. First, we'll compare coupons with yields, and then we'll talk about the main differences between the two.

- The interest rate paid on a bond's face value is known as the coupon rate (at par). At the same time, the term "yield to maturity" describes the rate of return an investment will earn on its maturity date.

- At regular intervals up to the bond's maturity date, investors will receive a coupon payment equal to a percentage of the bond's face value. While yearly return is generated by the current yield, which is tied to market fluctuations.

- In most cases, coupon rates are determined by the interest rates set by the government body based on the economic situation in the issuing nation. The current yield is determined by contrasting the coupon rate with the bond's current market price.

- It is preferable to purchase a bond at the discount rate, which delivers attractive returns on the maturity at face value since the bond price does not fluctuate over the bond's lifetime owing to the continued volatility of the market price.

- In accordance with statutory requirements, the coupon amount determines the bond's yearly or semiannual interest payment until maturity. Also, the yield specifies the total amount of money earned after reinvesting the coupon amount on the maturity date.

Some Considerations When Calculating Yield to Maturity

Assuming an investor buys a bond at face value, their yield to maturity will be equal to the coupon rate (the original price). If you're planning to purchase a new-issue bond and keep it until it matures, the only thing you need to worry about is the coupon rate. A bond's maturity yield might be greater than its coupon rate if it was purchased at a bargain. By contrast, if you pay more than face value for a bond, you will get a lesser return at maturity compared to the coupon rate.

What Relationship Exists Between Bond Yield and Price?

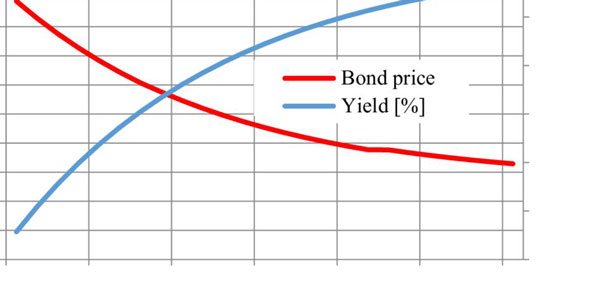

The bond's yield to maturity rate acts as a negative lever on its price. Higher interest rates mean that investors need a higher rate of return to keep their money in the market. Consequently, bond prices will decline, pushing the yield to maturity higher. As interest rates decline, bond prices rise in response to increased demand, and yields decrease as the bonds' fixed interest rates improve their appeal.

Conclusion

Investors who buy bonds from a corporation in a fresh offering and want to hold on to them until maturity should pay attention to the coupon rate. In this case, the yield to maturity is totally unimportant. However, yield to maturity is the most important metric for bond dealers to take into account when buying and selling bonds on the secondary market. This is owing to the fact that gains or losses from fluctuations in the bond's market price are included in the YTM computation.

What Does Annual Exclusion Mean?

Gifts to individuals are subject to gift tax and might reduce an individual's unified credit if they exceed the annual exclusion amount. An annual allowance for presents can be made in the form of money or property. The Internal Revenue Service has verified that the annual exclusion would remain at $15k in 2021.

Dec 18, 2023 Susan Kelly

Unlocking the World of Credit Card Travel Portals

Curious about credit card travel portals? Discover how to make the most of them in our simplified guide. From booking to benefits, we've got you covered.

Nov 23, 2023 Susan Kelly

What to Consider Before Buying a Short Sale

The value of the home you're selling might be estimated with the help of a CMA, which considers the prices of comparable homes in the area. It may benefit your case if you can prove that the value of your home has decreased, and there is little probability that it will increase in price sufficiently to cover your obligation.

Feb 16, 2024 Triston Martin

Review of American Express's Plum Card for 2022

To help you make better financial decisions, Bankrate is here. This post may include links to items from our business partners, but we take editorial integrity very seriously. Here's a breakdown of how we generate revenue. Even though the information on this page was correct at the time of publication, some of the deals featured here may have since expired. The deals on this website are subject to terms and conditions.

Jan 26, 2024 Triston Martin

Guild Mortgage Review: Evaluating an Established Leader in Home Loans

Guild Mortgage Company offers a wide range of loan programs, from fixed and adjustable-rate mortgages to FHA, VA, and reverse mortgage loans. Guild is also an approved lender of HUD's Home Equity Conversion Mortgage (HECM) program, allowing homeowners aged 62 and older to access their home equity.

Jan 11, 2024 Triston Martin

What Is a Minimum Investment?

Certain mutual funds let investors invest without a minimum amount, meaning that just $5, $10, or $100 can be invested. While there are mutual funds that don't require minimums, most retail mutual funds will require a minimum investment of $500 to $5,000.

Feb 04, 2024 Triston Martin