The Impact of Fed Tapering on the Markets

Feb 24, 2024 By Triston Martin

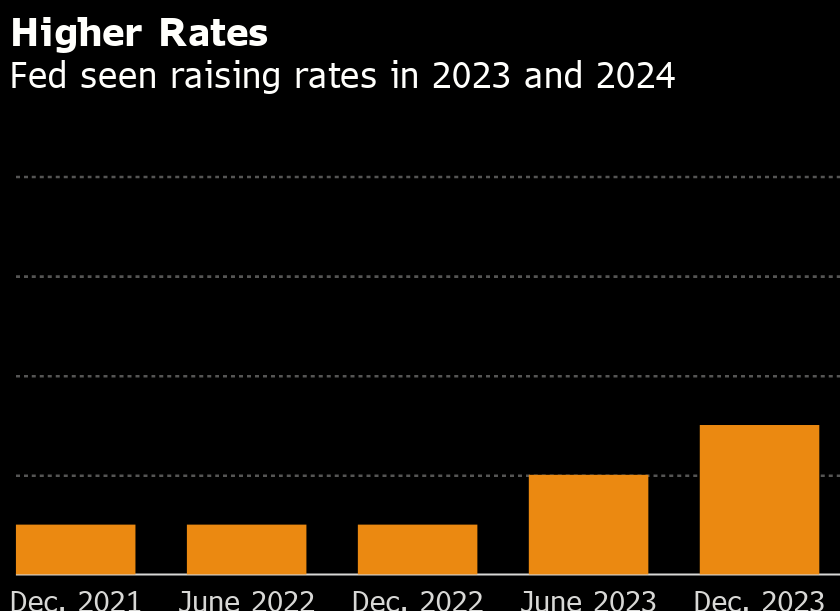

After announcing a drop in monthly purchases to $105 billion in December 2021, Fed Chair Jerome Powell said on November 3, 2021, that he aimed for zero net additions to the Fed's bond portfolio by the middle of 2022.

Beginning in December 2021, the Fed will begin reducing monthly bond purchases to end net new purchases by the middle of 2022. In October 2021, the Federal Reserve's balance sheet was $8.5 trillion, double the amount in early 2020 and nearly ten times in mid-2007.

For Fed Chair Jerome Powell, the policy is still very "accommodative," notwithstanding the taper.

The Markets' Muted Reaction

As of the close of trading on November 3, 2021, the S&P 500 Index was up 0.61 per cent, the Nasdaq was up 1.06 per cent, and the Dow Jones Industrial Average (DJIA) was up 0.2 per cent. The value of the 10-year U.S. Treasury Note fell by 0.16%

The Federal Reserve has become more forthcoming in recent years, notifying markets well in advance about potential policy decisions that will affect interest rates. This may explain why the markets had a muted reaction to the tapering news. As mentioned, the Fed has been hinting at tapering for the entirety of 2021.

Quantitative Easing Reduction

Interest rates have dropped to near zero thanks to

the Federal Reserve's extraordinary policy of quantitative easing (QE) has been implemented primarily through the purchase of large quantities of bonds. In the wake of the 2008 financial crisis, QE was implemented as a policy response to stabilise the economy and the stock market.

the Federal Reserve's extraordinary policy of quantitative easing (QE) has been implemented primarily through the purchase of large quantities of bonds. In the wake of the 2008 financial crisis, QE was implemented as a policy response to stabilise the economy and the stock market.

Bonds on the Fed's balance sheet have increased in value from $870 billion in August 2007 to $4.2 trillion as of the beginning of March 2020 and to $8.5 trillion by the end of October 2021, all as a direct result of QE.

Fed Policy Is Still "Accommodative"

At a press conference on November 3, 2021, Fed Chair Powell reiterated that the central bank's approach would remain "accommodative" to maintain interest rates around zero. In response to a follow-up question about inflation, he replied, "It would be premature to hike rates today."

As a result of the Fed's newest boom in bond purchases in reaction to the pandemic, the size of its vast balance sheet had increased by a factor of two from its already-historically-low level before the pandemic began. The goal of keeping interest rates relatively steady is compatible with the "accommodative" nature of the tapering announced on November 3, 2021, which will continue to add to the balance sheet.

Asset price bubbles and tapering

Critics of QE argue that it has caused asset price bubbles because the prices of financial assets (especially debt instruments like bonds and equities) tend to be inversely tied to interest rates. Low borrowing rates and low returns on financial assets may have also contributed to speculative bubbles in the prices of hard assets like real estate. Another possible effect of QE is the increasing investment in cryptocurrency. Speculative bubbles fueled by historically low-interest rates could burst if tapering causes interest rates to rise appreciably.

Inflation Reduction Through Tapering

There has been an increase in inflation, with the Consumer Price Index for All Urban Consumers (CPI-U) showing a 6.2% increase in the 12 months through October 2021, up from a 5.4% increase in the 12 months through September 2021. Since the period ending in November 1990, this was the biggest 12-month

Powell has said that the Fed views transient factors such as temporary "supply constraints" as the key drivers of recent price spikes, suggesting that monetary tightening, such as through tapering, maybe a policy lever to rein in inflation. Accordingly, he has cautioned that monetary tightening, intended to reduce inflation, may have the opposite effect and instead harm economic growth and job creation in the long term.

When interest rates increase, stock prices often rise.

Financial markets expert Mark Hulbert recently penned the following column: "Increasing [interest] rates are often seen as negative by the general public. With interest rates on the rise, bonds have become a more formidable competitor to equities. This also means that the value of stocks is reduced using conventional discounted cash flow analysis. A rise in interest rates reduces the present value of dividends and earnings expected from a company's shares."

Hulbert uses data collected since 1990 to reach the opposite result. He finds that the S&P 500 tends to do better after a decision to raise the Fed funds rate rather than a decision to lower it.

Unlocking the World of Credit Card Travel Portals

Curious about credit card travel portals? Discover how to make the most of them in our simplified guide. From booking to benefits, we've got you covered.

Nov 23, 2023 Susan Kelly

Time to Get a Credit Card

Instead of getting a credit card for a kid who is still young, you should probably get them a debit card connected to their bank account. Consider getting the youngster an authorized user status on a credit card issued in the parent's name but with a modest credit limit later.

Jan 02, 2024 Triston Martin

Can I Purchase A Car Using A Credit Card?

It is possible to buy a car with a credit card, although it may only sometimes be the most practical or cost-effective option. Some car dealerships may accept credit cards, but they may charge a processing fee. Credit cards typically have higher interest rates than car loans, so if you cannot pay off the balance in full each month, you may pay more in interest over time. It is essential to carefully consider the card's terms and the potential fees and interest charges before using a credit card to buy a car.

Oct 28, 2023 Triston Martin

Review of American Express's Plum Card for 2022

To help you make better financial decisions, Bankrate is here. This post may include links to items from our business partners, but we take editorial integrity very seriously. Here's a breakdown of how we generate revenue. Even though the information on this page was correct at the time of publication, some of the deals featured here may have since expired. The deals on this website are subject to terms and conditions.

Jan 26, 2024 Triston Martin

Your Complete Guide to Statistics

Unveil the core of statistics, its multiple categories, and why it plays an essential role in many areas.

May 18, 2024 Susan Kelly

How to Get Home Equity Loan with Bad Credit

Need help getting a home equity loan with bad credit? Learn how you can secure financing, even with a low credit score. Get expert advice on the best options and practical tips on improving your credit rating.

Oct 16, 2023 Susan Kelly