Competition between Credit Risk and Interest Rate Risk

Jan 28, 2024 By Triston Martin

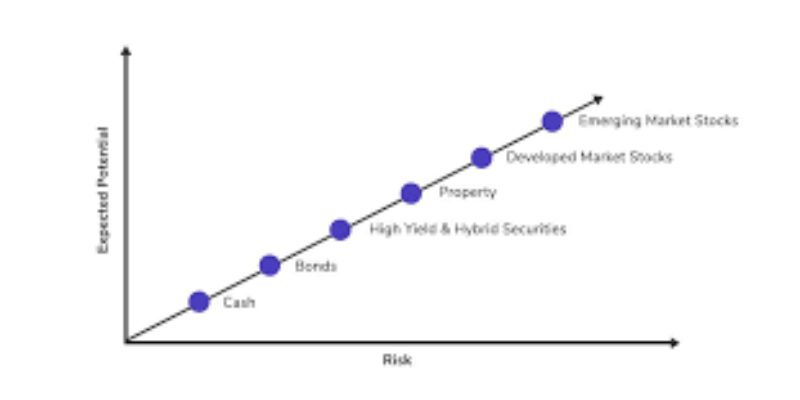

It is common to categorize bonds purchased for investment as "low risk" versus "high risk." Interest rates and credit risk are present when investing in bonds. These two elements might have different results for various bond market investment forms. Bonds are often seen as a safer investment option. Even though bonds have a lower level of risk than many other investment options, they are not completely safe. Before putting money into bonds, you must learn about their potential dangers. Bond investors must be prepared to take on two primary types of risk: credit risk but instead interest rate risk. Detailed explanations of each are provided below.

Borrowing Costs

A diamond's "interest rates" is its susceptibility to price fluctuations caused by changes in market interest rates. Higher-risk bonds (those with longer tenure) appreciate when interest rates fall and underperform when rates start to climb. Never forget that bond rates rise when bond prices fall. This is because interest rates respond to economic growth, and a slowing economy means lesser growth. Securities with a high sensitivity to changes in interest rates often do well during such periods.

Possible Loss On Credit

As opposed, the danger of defaulting on something like a bond is known as credit risk. There is a possibility that some of the investors may not get their money back, both in terms of principle and interest. Because when a borrower's financial situation is stable, high-risk individual bonds perform well. Bonds having a high credit risk will decline in value if the issuer has financial difficulties. Credit risk is not limited to individual loans or investments. These do well when the economy strengthens and worse as it weakens.

Potential For Risk By Bond Asset Class

Some investments are more vulnerable to interest rate fluctuations than others. U.S. Treasury bonds, Reserve bank Inflation-Protected Securities (TIPS), mortgage-backed securities, and exemplary corporate but rather municipal bonds are all examples. Credit risk is greater for some types of bonds, including high-yield bonds, developed market indebtedness, suspended bonds, and lower-quality municipal bonds. Knowing this distinction is essential if you are trying to diversify your bond portfolio effectively. Bonds with varying risks should be used to create a more well-rounded portfolio.

U.S. Treasuries And Treasury Inflation-Protected Securities

Because the United States government is still the world's safest borrower, many believe government bonds pose almost no credit risk. It has never missed a payment on a bond loan before. Therefore, the performance of these bonds is relatively immune to a sudden halt in growth. A financial crisis may be beneficial since bond investors seeking safety would be more likely to purchase high-quality bonds during market instability. However, interest rate risk is most felt by holders of Treasuries and TIPS when rates rise. Treasuries and TIPS yields increase as inflation decreases once the market anticipates a Fed rate hike or when investors fret about inflation. In such circumstances, long-term bonds will underperform short-term bonds significantly.

Securities Backed By Mortgages

Also, the credit risk associated with mortgage-backed securities (MBS) is often modest. The primary reason is that the vast majority are guaranteed by the government or sold as part of a diversified portfolio. If one asset in a pool fails, it won't hugely affect the full pool or fund. However, MBS is very sensitive to changes in interest rates. Two scenarios exist in which the MBS asset type suffers damage. To start, a sudden rise in interest rates might lead to a decline in market values. Also, interest rates have dropped significantly. This domino effect in the housing market began with mortgage refinancing requests from current homeowners. The principal is paid back in full when a mortgage is refinanced. This initial capital must be re-invested at rates and with a lower payoff than investors had anticipated. With the principal withdrawn, they get no interest.

Conclusion

For example, during the global financial crisis of 2008, central bank policy emerged as the single most influential factor shaping bond markets. Interest rate risk, also known as duration risk, was not a major issue since inflation had vanished and interest rates were at all-time lows. It would benefit the investors to pay more attention to credit quality. To put it simply, that's not the case anymore. While central banks still have a role, they are only one among several variables. They are doing more than simply adding money to the economy. Already, this same Fed has raised rates twice, and indeed the Bank of Japan is concentrating on yield curve targeting. Governments are also shifting toward more aggressive monetary policies, which may fuel inflation, especially in countries like the United States, where employment levels are already at full capacity.

Securing Your Financial Future: The Role of Credit Life Insurance

Protect your loved ones from financial burden with Credit Life Insurance. Learn how it works and who needs it in our comprehensive guide.

May 13, 2024 Susan Kelly

To Invest in Africa, Consider These African Exchange Traded Funds

There has been a recent influx of capital into Africa due to its rising market potential. According to the World Economic Forum, more than half of the world's fastest-growing economies since 2000 have been found in Africa. In this article, we examine the economic growth in Africa since the year 2000, and its potential in the future.

Dec 06, 2023 Triston Martin

How to Get Home Equity Loan with Bad Credit

Need help getting a home equity loan with bad credit? Learn how you can secure financing, even with a low credit score. Get expert advice on the best options and practical tips on improving your credit rating.

Oct 16, 2023 Susan Kelly

What Are The Most Important Things You Should Remember About Your Credit Score?

A number between 300 and 850 indicates a person's creditworthiness. Equifax, Experian, as well as TransUnion are the three major credit reporting agencies. Lenders will be far more likely to provide credit if applicants have high credit scores. Financial organizations often use the utilization of the FICO rating system.

Feb 24, 2024 Triston Martin

Life Insurance As An Asset | What You Need To Know

Life insurance can serve as a financial asset during your life. Learn how it works and how it can be an asset.

Feb 11, 2024 Triston Martin

529Plan Made Simple: Your Guide to College Savings

Find how to save for college effortlessly with our comprehensive guide to 529 plans and college savings strategies.

Mar 13, 2024 Susan Kelly